Essential Guide to Japanese Candlesticks

Candlestick Patterns Cheat Sheet

Author

Tobi Frenzen

Published

October 31, 2024

Updated

March 31, 2025

Author

Tobi Frenzen

Published

Oct 31, 2024

Updated

Mar 31, 2025

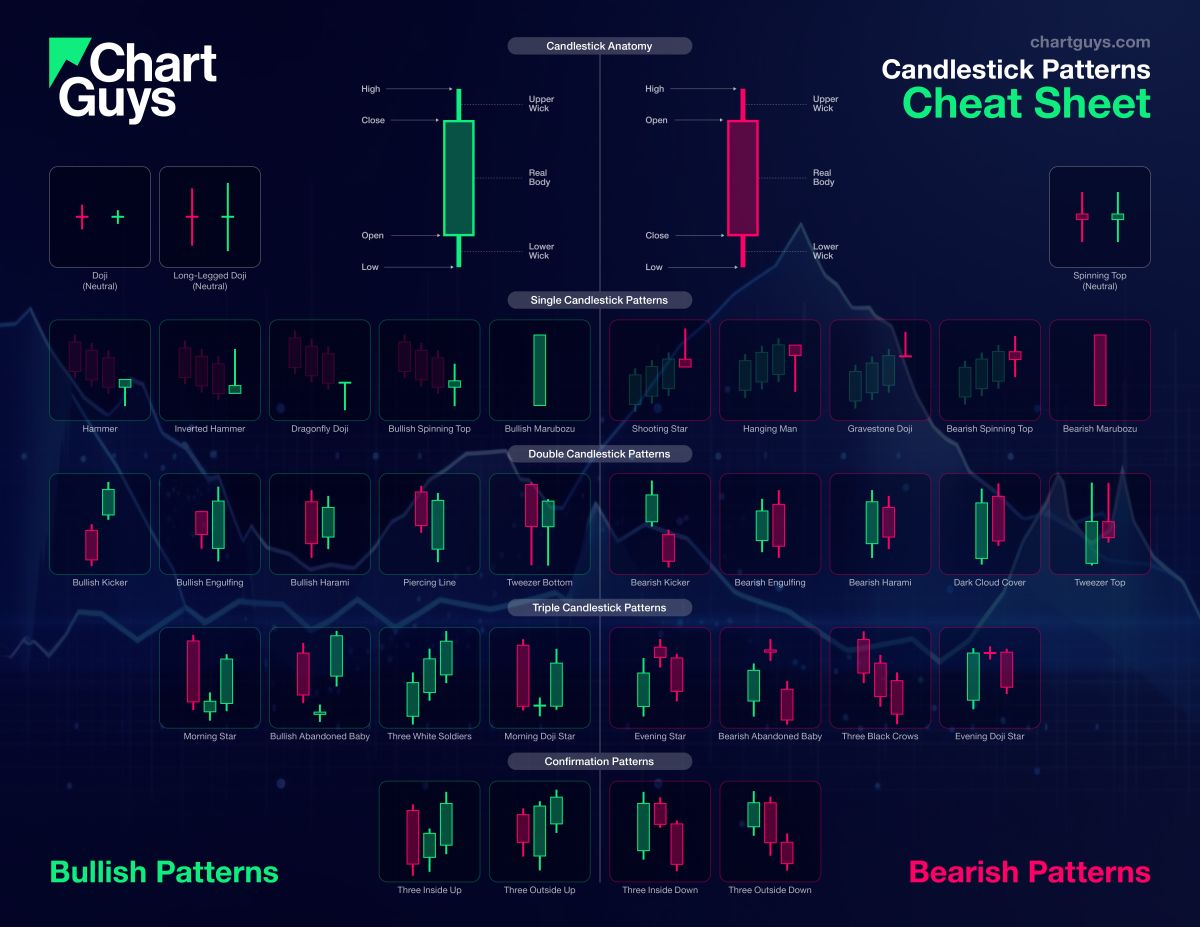

Enhance your trading with our comprehensive and interactive cheatsheet of Japanese candlestick patterns. Learn to identify key single, double, and triple candle formations that signal potential market reversals or continuations. Understand their appearances, typical locations, and implications to make more informed trading decisions.

Anatomy of a Bullish Candlestick

Candlestick Pattern Cheat Sheet

A bullish (green) candlestick indicates upward price movement, where the closing price is higher than the opening price, suggesting buyer control. The candlestick’s body shows the open-to-close range, with a longer body signaling strong buying momentum. Wicks (shadows) above and below the body display the period's high and low prices; a long upper wick suggests seller resistance, while a long lower wick suggests buyer support.

Basic Elements of a Bullish Candle

-

Real BodyThe rectangle showing open-to-close price range

-

Upper WickThe line above shows the highest price

-

Lower WickThe line below shows the lowest price

-

ColorGreen/white, signifying up moves

Bullish Candle Diagram

Anatomy of a Bearish Candlestick

Candlestick Pattern Cheat Sheet

A bearish (red) candlestick signals downward price movement, where the closing price is lower than the opening price, showing seller dominance. The body represents the open-to-close range, with a longer body indicating strong selling pressure. Wicks (shadows) above and below the body display the period's high and low prices; a long upper wick suggests buyers attempted to push higher but failed, while a long lower wick suggests sellers met buyer support.

Basic Elements of a Bearish Candle

-

Real BodyThe rectangle showing open-to-close price range

-

Upper WickThe line above shows the highest price

-

Lower WickThe line below shows the lowest price

-

ColorRed/black, signifying down moves